How To Travel: Utilizing Credit Cards

This is the second post in my “How To Travel” series. To read “How To Travel: An Introduction” click here.

After reading the title of this post you’re thinking ‘what do credit cards have to doing with traveling?” That is a fair question as most don’t know to make the connection. Credit card debt is a serious issue which is why there is so much negativity and fear out there about them. But here’s the thing, when chosen properly and used wisely credit cards give you rewards points which come in very handy when traveling.

Like most people, I hate paying for things. If I can find a way to do something and not pay for it I’m all about it. My biggest reason for not doing something is simply not wanting to spend the money. I’ll walk instead of Uber and I’ll cook instead of eating out. But at the end of the day most things in life aren’t free which means I’m constantly spending money. Everyone has their preferred method of payment. Some say cash is king. Others prefer debit cards. And I hear there’s still a subculture of people that actually write checks (not making that up). What do each of these people have in common? They’re completely missing out on the rewards.

A Quick Warning:

Before we get too far, let me say that the advice below only works if you are aware of your finances and responsible with your credit cards. I treat mine like a debit card and pay each of them off at the end of every week. Yes, I pay mine off weekly. Which may seem OCD but it keeps me from ever living beyond my means. The reason credit cards have gotten a bad reputation is because people think having one gives them an excuse to buy whatever the fuck they want. It doesn’t. It’s imperative for you to understand your budget and finances before you get a credit card. If you decide to get one after reading this post don’t change your spending habits but simply enjoy the rewards. You’re doing all of the work already (spending the money) you might as well get something out of it.

If used properly, credit cards can help you secure a free flight to anywhere in the world. I booked my flight from Melbourne to LAX in May ($875) for free with my points. Thank you Chase!

Once you’ve decided you’re responsible enough for a credit card (or two) what’s next? You need to figure out which credit card is best for you based on your spending habits and your goals.

What you buy most and what you want to do with the rewards you earn will dictate which credit card is best for you. I only got a credit card to help me travel. Which means I found the ones that help me do that best. To be honest, I was pretty pissed I didn’t get one in college to start earning points even sooner. Bali would have been a nice graduation gift.

There are a shit ton of credit cards out there, but only a few for people who love to travel and travel often. Below is a list of the credit cards I have along with a few card highlights.

Barclay Arrival +

-2x Miles on all purchase

–Earn 50,000 bonus miles as a sign up bonus (after spending $3,000 in 3 months)

–Get 5% miles back when cashing your miles in for a trip

-No foreign transaction fees

-$89 fee (waived the first year)

Discover IT

-5% cash back in rotating categories each quarter (currently gas stations and wholesalers)

-1% cash back on all other purchase

-Matches your cash back total at the end of the first year

-0% APR on balance transfers

-FICO Credit Score on each statement

-No Fee

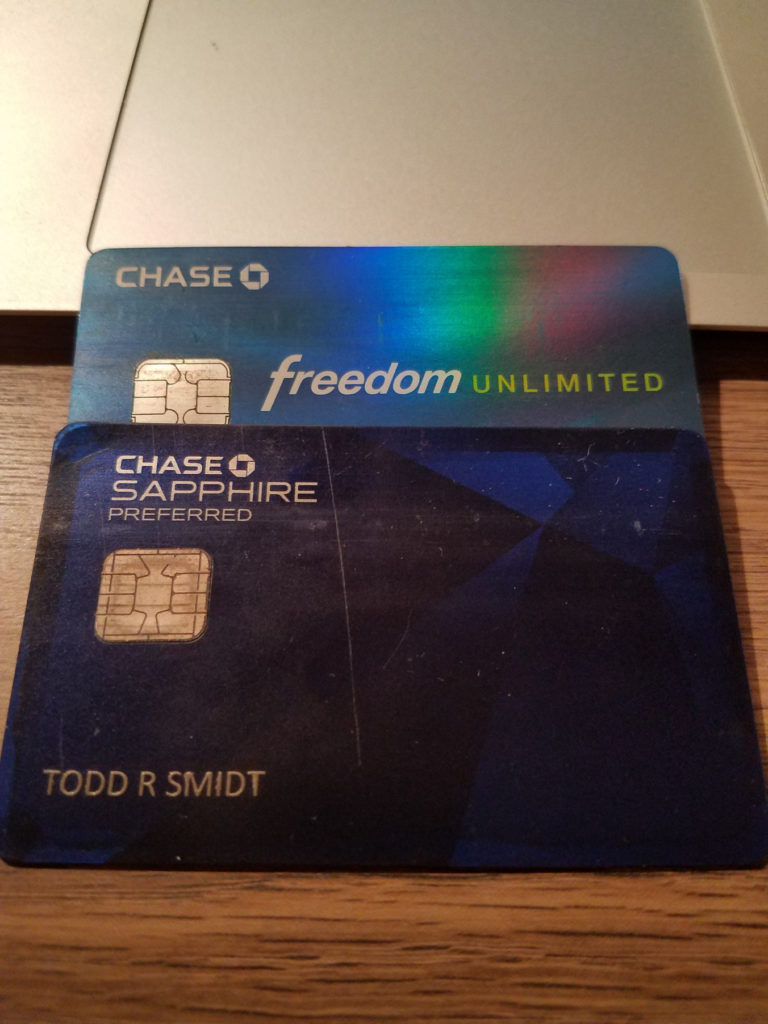

Chase Sapphire Preferred

-Earns 2x points on dining and travel, including expenses like food and grocery delivery services, tolls, Uber and more

-1 point on everything else

-1:1 Point Transfer to other airlines

-No Foreign transaction fees

-50,000 sign up bonus points (spend $4,000 in the first 3 months)

–Chip and Signature Technology, which provides better security and wider acceptance when traveling overseas

-$95 annual fee (waived the first year)

Chase Freedom Unlimited

-1.5% cash back on everything

-$150 bonus after spending $500 in the first 3 months

-0% APR for 15 months from opening account

-No Fee

I know what you’re thinking, no, you don’t need 4 credit cards. I have each of mine for a different reason and use them strategically to maximize the reward points. But I’ll give you the same advice I give everyone when I first start talking credit card strategy.

Establish your goal and timeframe.

Get the Chase Sapphire Preferred.

For example, if your goal is to go to Prague next year the best thing you can do is get the Chase Sapphire Preferred. You then start working toward spending $4,000 in the first 3 months to get the 50,000 point bonus giving yourself a free flight to Prague. It sounds like a lot of money, but if you actually examine your finances you’ll find it’s not hard to do. If you use the Chase Sapphire Preferred for ALL of your spending those first 3 months you’ll have no problem reaching the required spend and cashing in on the rewards points. If you’re worried that you won’t be able to spend $4,000 here are a few ways I’ve found to make it easier (and cheaper) to do:

-Whenever you go out with friends/family pick up the tab and have them pay you back via Venmo, Square, cash, etc

-Put all your bills/utilities on your credit card (cell phone, health care, gas/water etc)

-Plan a trip and put all the expenses on your Chase credit card

-Wait to make a ‘big purchase’ until after you get your card (furniture, car, etc)

You’ll get double the points on anything travel (uber, taxi, RV rental, trains, flights, etc) and restaurant (anything food related not counting grocery stores).

If you travel for work this card is perfect for you. Your company will take care of the required spend for you. A lot of my friends have the Southwest credit card which is fucking stupid. Yes, you get 2x the points when booking a Southwest flight, but guess what, you get the same amount of rewards points booking a Southwest flight using your Chase Sapphire Preferred. You can transfer points to basically any airline 1:1 which means if you want to switch between Southwest, Delta, or American you can. You’re not stuck with one airline if they don’t have your flight or a different airline has it cheaper. You simply transfer your Chase rewards points to whatever airline rewards program you prefer allowing yourself more options.

Quick Note on Strategy: I recently got the Barclay Arrival + credit card because I wanted to have at least 50,000 points for next year since my trip to Asia used all my Chase points. I’ve set up my system so I can rotate ‘main’ cards each year racking up the points and alternate the spending of my points. This way I always have enough for a free international flight. For example, I have 63,374 Barclay points that I’ll use next year when I go on my next trip and in the meantime I’ll start saving up Chase points again so in 2 years I can use those.

I had to spend $3,000 in the first 3 months but I didn’t have any big purchases coming up and didn’t want to buy something just to meet the required spend (you should not change your spending habits to meet the required spend). I looked at my finances and realized that I could pay my rent on my credit card. I usually Venmo my landlord at the start of each month. $450 from my bank account to his. For a 3% fee I could charge my credit card. I wasn’t wild about adding $13 to my rent each month but it meant instead of spending $3,000 in 3 months all I had to spend was $1,611 which is all too easy to do. Every time you spend money you have to learn to think “this sucks, but how can I get rewarded for this.”

Pro Tip:

I strongly suggest not opening more than 1 card at once to start with. It’s best to open one card at a time and dedicate your spending on that card until you’ve reached the amount needed for the sign-up bonus.

Last quick note on the Chase Sapphire Preferred, it’s impossible to not feel like a baller when using this card. It’s sleek, enabled with chip security, but more importantly, it’s heavier than any card I’ve ever held. When I use my card (especially abroad) and the cashier takes it from me they look at me with a ‘who is this guy and how can he afford to use this card’ look which I’d be lying if I said I didn’t enjoy just a little.

For more information about the Chase Sapphire Preferred check out The Points Guy, 5 Additional Benefits, and NerdWallet

OK, you’ve met the required spend for the Chase Sapphire Preferred card. What’s next?

Get the Chase Freedom Unlimited.

There’s nothing fancy about the Chase Freedom Unlimited nevertheless it’s effective. While the Sapphire Preferred is boom or bust (2% or 1% cash back) the Freedom Unlimited does nothing but consistently get on base with its 1.5% cash back on every purchase. I won’t go into too much detail but if you’d like more information check out NerdWallet and The Points Guy.

While you should still use your Chase Sapphire Preferred card on any travel or dining purchase ($500 in 3 months is super easy to do) everything else should be put on your Freedom Unlimited card to maximize your rewards earning.

The best thing about having these two cards? You can combine the points you’ve earned on each card into one account.

Since the Chase Sapphire Preferred is an “elite” tier Chase card you’re allowed to pair it with a lower tier card. Meaning everything you buy will get 1.5% or 2% cash back. It makes earning rewards points a lot easier when you can alternate these 2 cards to maximize your points earned by combining them.

The Freedom Unlimited sign up bonus is 15,000 points ($150) if you spend $500 in the first 3 months. For those who aren’t great at math, that’s 65,000 Chase points just by getting these 2 cards and meeting the spending requirements. You’d be hard pressed to find a place in the world you can’t get to with 65,000 points. If you’re not interested in using your points to travel you can also get cash back, gift cards, etc. 65,000 points is equal to $650 in cash back rewards to use however you want.

Points on Points on Points:

Chase gives out bonuses for Referring A Friend. 10,000 points for the Chase Sapphire Preferred and 5,000 points for the Chase Freedom Unlimited. If you learned anything from this post and are interested in being my ‘referred friend’ leave your name and email below!

Even if you decide the two Chase cards aren’t for you I hope this post has helped you understand how rewarding using a credit card can be. Spending money is a lot more enjoyable when you’re getting some of it back and putting it toward your next adventure.

Few things beat exploring the world for free.